Everybody else uses a first name or birthday combo

- 9 Posts

- 277 Comments

Hah, just be aware and courteous and it really won’t matter.

If you’re taller, always make sure there aren’t any shorter people behind you. If you’re having fun, smile, move a little, enjoy the atmosphere. You’ve got nothing to worry about and have a great time!

Your biggest worry would be the battery, they don’t like to be at 100% all the time. If the phone charging limit can be adjusted you should be good to go. But I’d watch the battery closely for any swelling.

Conveniently left out the relevant part:

However, they (they as in Gen Z) are far less (less as in compared with the Millennials) adept at understanding how to use technology to create useful solutions to their business challenges — for example, using Outlook to send e-mail, Word to prepare documents, Excel to analyze data and PowerPoint to communicate through presentations.

This, togheter with the previous paragraph which you mentioned, is talking about a direct comparison of Gen Z and Millennials and it directly states Gen Z is less tech savvy than Millennials.

This study does not say at all that tech literacy has been declining.

But it does, like multiple times, even on paragraphs you quoted.

I provide you with multiple sources explaining how tech literacy is declining, you keep saying they don’t compare. What do you think less means? What do you think declining means? It means they are comparing.

Try wasting someone else’s time lmao

Nowhere have they been compared

less equipped

Can’t do the reading for you…

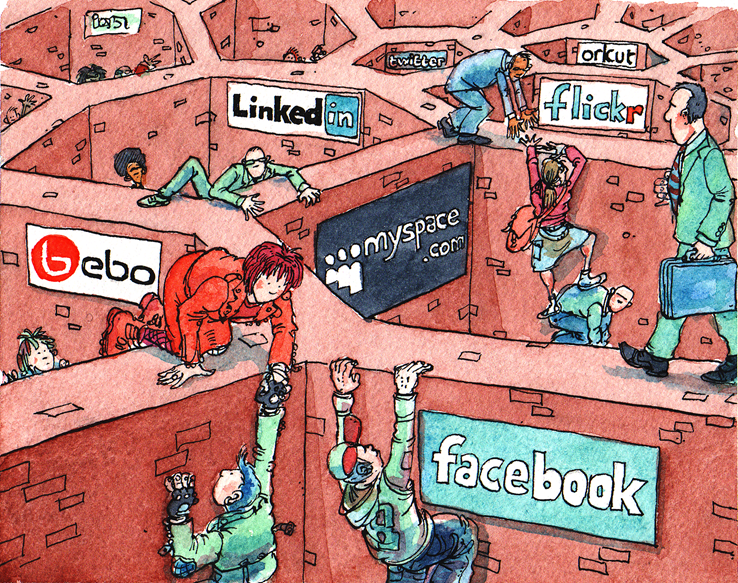

This stuff has been talked about for at least 5 years. Here’s two studies that have come to the same conclusions. By The University of Toledo and the ICILS EU.

“The assumption is that because Gen Z and even millennials spend a considerable amount of time on technology that they are technology savvy,” Irish said, according to WorkLife.

“This is a huge misconception. Sadly, neither watching TikTok videos nor playing Minecraft fulfills the technology brief.”

Unfortunately, Gen Z may be less equipped for the future of technical work than we think. The key reason is that traditional education is not preparing the new generation for a digitally-driven job market. A recent study from Dell, which surveyed 15,000 Gen Z members, found that 37% of them feel that schools are not adequately preparing them for the demands of a digital world. Furthermore, 56% have received minimal to no digital skills education.

Across the nation, the basic skills of reading and comprehension have been devalued over recent years, intellectual curiosity among younger generations has grown weaker, and AI is rapidly replacing human thought.

You’ll never get anywhere near the level of interaction making an approved list. it’s a level of trust you have in the platform to respect their safe space. And hey, I blocked them on the third post I saw, so if you’re that bothered it might be a you-problem.

The point of forums is to make a place you’d wanna visit. If enough people want to visit that same place it’s one worth having.

No need to be an asshole about it. Their point about the next generation becoming less technological literate has been widely discussed and isn’t even a controversial opinion.

Wait till you hear about our bishops…

OOP programming in PHP is pretty fun, keeping up with it’s deprecations and vulnerabilities is not

Hmmm, some InboxTimeouts are to be expected. The second one could be the result of a scraper or bot. It’s still strange your federation list is empty. I’d take a look at the database, clearing the federation queue (public.federation_queue_state) is a good idea. ‘public.instance’ should be populated with servers (mine has 2836). Peaking into the log files of the database could give some more insight as well.

A successfully federated incoming action will look like this:

2025-07-14T22:40:54.321151Z INFO HTTP request{http.method=POST http.scheme="http" http.host=0d.gs http.target=/inbox otel.kind="server" request_id=61bf0ea2-8df3-42ff-a433-3bec8b37047c}: actix_web::middleware::logger: 10.10.0.1 'POST /inbox HTTP/1.1' 200 0 '-' 'Lemmy/0.19.12; +https://lemmy.ml/' 0.158242Your outgoing federation seems to be fine now on my end, this is how my server sees yours:

id 2794; ;domain "blog.kaki87.net"; published "2025-06-30T11:35:32.398830Z" ;updated "2025-07-14T00:42:32.758669Z" ;software "lemmy" ;version "0.19.11" ;federation_state: ;instance_id 2794 ;last_successful_id 46037 ;last_successful_published_time "2025-07-14T21:12:27.481507Z" ;fail_count 0You could try updating or reinstalling your back-end as well, lemmy is at 0.19.12.

I love these so much thanks! On YouTube there’s also a ton in video format, like this one by Brian May.

/inbox is the endpoint for federation with ActivityPub, so definitely on the right track. Try increasing verbosity to get a full stack traceback to where in the code it’s bugging.

InboxTimeout means your server is taking too long to process API calls to /inbox, I’ve had them before too due to misconfiguration of the reverse proxy. Make sure you’re passing on the right headers, especially the IP headers so they aren’t rate limited and the Accept header so your server knows to send json when requested.

Troubleshooting federation gives many options for testing and checking your configuration, running through them might give your more insight.

Lemmy’s docs show how to increase the verbosity of your logs, taking a look at them could point to possibly issues.

Compare https://blog.kaki87.net/api/v3/federated_instances with https://jlai.lu/api/v3/federated_instances and I don’t think your server is federating properly. This graph of instance health shows federation stopped around 20/06.

Since then, your new posts have federated to for example my server and lemmy.world, but 2 new posts from the last week did not make it to my server.

I tried voting on this post with lemmy.world and the same post with 0d.gs which do not seem to federate but are visible on their respective servers.

The strange thing is, in my Lemmy back-end, everything seems normal, and your server is telling mine it’s receiving correctly, but we can see it is not.

I left a comment on your server but it doesn’t seem to be federating so I’ll leave it here as well! original comment

Terribly sorry about nerd sniping you! I’m the owner of martijn.sh, and I’m guessing it was only a matter of time. We’re solving the same problem in a completely different way though, so I’ll definitely be following your progress and might use it for my lemmy instance as well.

The only difficulty I’ve found is when federating our small instances to lemmy. Your community only federates with other servers if at least one user on that instance is subscribed to it. An easy way to fast track federation is using lemmy-federate. If you register your instance and your community, an army of bots will automatically subscribe to your community making it available on many more instances at once. The only reason your server now federates with mine is because I searched for it manually and subscribed that way.

Anyway, best of luck on your blog. If you’ve questions or want to discuss, feel free to send me a message!

If we look at historic crashes, they had major catalysts causing mass sell orders. Right now markets have had time to adjust because the speed of decline has been very slow.

Markets are also largely speculative, many stocks are traded way above their fundamental value (think Microsoft, tesla, or coca-cola). These will probably be hit the hard, algorithms will default to what a stock should be and drop hard. But these companies might have the strongest chance to bounce back as well.

Companies with the strongest books will be safer, but many more risk taking companies won’t be as lucky. This is part of what due diligence of a stock will tell you, but also probably one of the hardest parts of investing.

As long as decline is slow, stability can be found. But when uncertainty rises fast, so does the unstability of the stock market. Catalysts such as the public losing confidence in banks causing a bank run, companies downsizing at unseen scales to cut costs, or global political instability are possible.

TLDR: it needs to get way worse, very quickly for the market to crash

My first year professor in electronics started his first lecture “yeah so forget everything you’ve learned about electricity because it’s wrong” - then gave out an infinite matrix of resistors and made us cry.

Ah I’ve found my people, I’m doing 9 atm to complete a 3x3 square in the overview. Only on my laptop though, using the trackpad guestures to switch or overview.

1: Terminal 2: Editor 3: Git

4: Terminal 5: Browser 6: Browser

7: Terminal 8: Any GUI 9: Rest